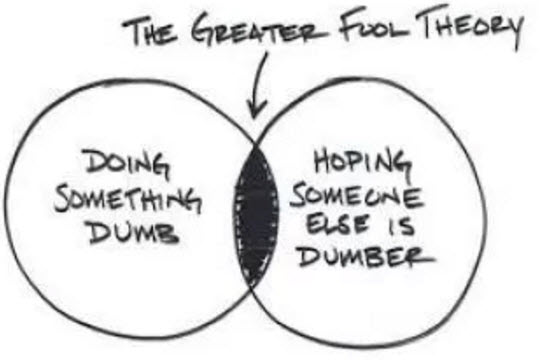

On the heels of another Meme stock rally, it’s a good time to talk about the greater fool theory.

– If you don’t know what the greater fool theory is, chances are you qualify.

– If you’re searching Reddit threads for stock tips, you could be… the greater fool.

– If you don’t understand the economics of a business or how the market values a particular industry, but you bought the stock anyway, you guessed it….

Eventually, the herd catches on, and there’s no greater fool to buy into the mania. It happens with tulips and desert condos and beanie babies and it happens with meme stocks. Every. Time.

Warren Buffet and Charlie Munger offer sage advice:

“It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.” – Charlie Munger

“Charlie and I are not stock-pickers; we are business-pickers.” – Warren Buffet.

Said another way, if you pick stocks, you are gambling; if you buy stakes in businesses that you intend to hold for the long-term, you are investing.

And if you can’t or won’t spend the time to understand the underlying economics of a business and what makes it special, don’t invest in individual businesses.

The alternative? Stop trying to be smart and aim for “not stupid.” Stop looking for needles in haystacks. Ignore the people telling you this straw is a can’t-miss needle. Just buy the haystack.